Real Estate Crowdfunding: How to Invest in Property with Little Money

Real estate has always been one of the most reliable investment vehicles for building wealth. However, the traditional path of real estate investment usually requires a significant amount of capital upfront, making it difficult for many individuals to participate. Fortunately, real estate crowdfunding has emerged as a modern solution, allowing everyday investors to break into the property market with as little as a few hundred dollars.

In this guide, we will explore how real estate crowdfunding works, the different types of investments available, and how you can get started investing in real estate with minimal capital. By the end of this article, you will have a thorough understanding of whether this form of investment is right for you and how to make the most of the opportunities it presents.

What Is Real Estate Crowdfunding?

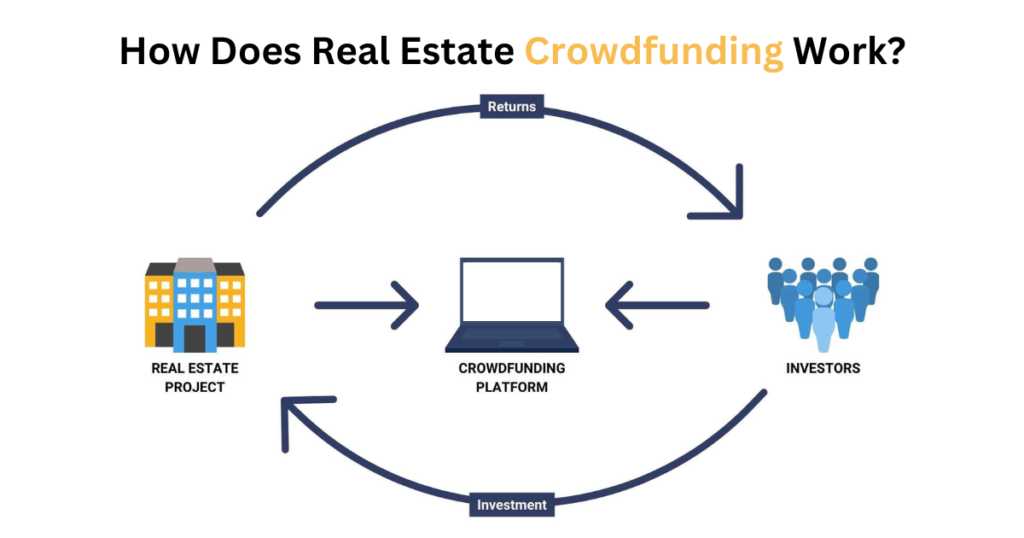

Real estate crowdfunding involves gathering funds from investors to finance real estate ventures collectively. This can include residential developments, commercial properties, or even large-scale projects like hotels and office buildings. Instead of purchasing an entire property, investors buy shares in the project, and their returns are based on the profits generated by the investment.

Real estate crowdfunding platforms, which operate online, connect investors with property developers or project sponsors. These platforms act as intermediaries, providing access to vetted investment opportunities, ensuring that the financial structure is in place, and handling much of the legwork involved in real estate investing.

How Does It Differ from Traditional Real Estate Investment?

Unlike traditional real estate investments, where investors must buy, maintain, and manage the property themselves, crowdfunding is a much more hands-off approach. Crowdfunding allows investors to contribute smaller amounts of money to projects, leaving the management and execution of the property development or rental to experienced sponsors.

In traditional real estate, investors bear the full responsibility for the success of the property, including finding tenants, handling maintenance, and overseeing renovations. Real estate crowdfunding shifts much of this burden to professionals, allowing investors to focus solely on contributing capital and earning returns.

How Does Real Estate Crowdfunding Work?

The process of real estate crowdfunding is relatively simple:

- Choose a Platform: Investors must first select a real estate crowdfunding platform. Each platform offers different types of projects, ranging from residential homes to large commercial properties, so choosing one that aligns with your investment goals is essential.

- Browse Opportunities: Once registered, investors can browse through available projects. The platform will provide details about the project, including its location, expected returns, the amount of money being raised, and the experience of the sponsor.

- Invest: After selecting a project, you can invest a specified amount of money—usually a minimum of $500 to $1,000, depending on the platform. The investment amount is pooled with contributions from other investors.

- Earn Returns: As the project progresses, investors may receive distributions based on rental income, interest payments, or profits from the sale of the property, depending on the type of investment.

- Exit: Once the project is complete or sold, investors typically receive their share of the profits, ending the investment cycle.

Types of Real Estate Crowdfunding Investments

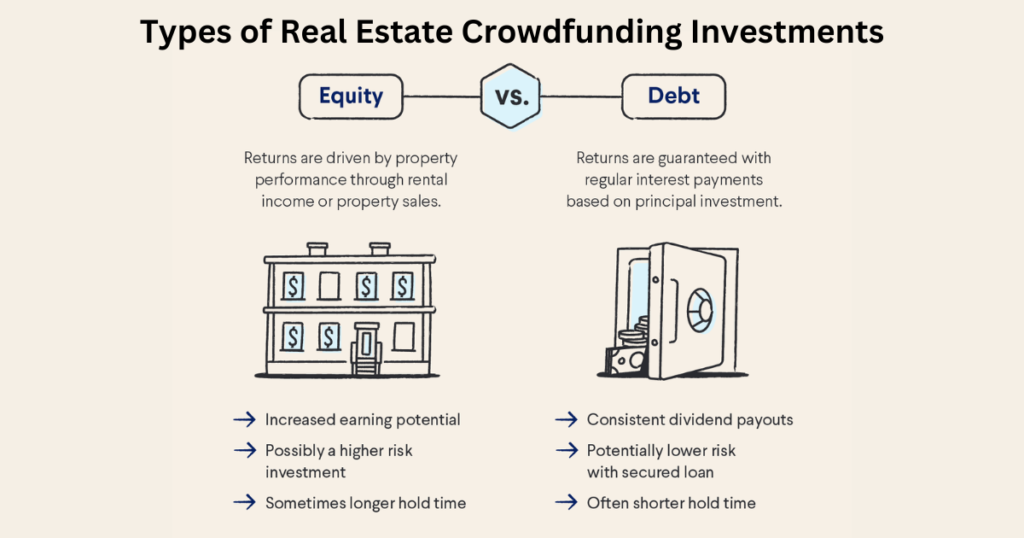

There are different types of real estate crowdfunding models that cater to varying risk appetites and financial goals. The two most common types are equity crowdfunding and debt crowdfunding.

Equity Crowdfunding

In equity crowdfunding, investors purchase shares in a specific real estate project. In this model, the investor is essentially a part-owner of the property. The returns on an equity crowdfunding investment typically come from rental income or profits made when the property is sold after appreciation.

Pros:

- Higher potential returns: Since you’re sharing in the property’s profits, your returns can be substantial if the project succeeds.

- Passive income: Many equity investments provide a steady stream of rental income.

Cons:

- Higher risk: If the project fails to perform as expected, you could lose part or all of your investment.

- Long-term commitment: Equity investments are often held for several years until the property is sold, making them less liquid.

Debt Crowdfunding

Debt crowdfunding, on the other hand, involves lending money to the project sponsor or developer. The sponsor uses this capital to complete the project and pays interest to investors. Once the loan matures, the principal and interest are repaid.

Pros:

- Lower risk: Debt crowdfunding generally carries less risk than equity investments because you’re lending money and have a claim to repayment.

- Steady returns: Investors receive fixed interest payments, offering a predictable income stream.

Cons:

- Lower potential returns: Interest payments are typically lower than the profits you could earn from an equity investment.

- No ownership: As a debt investor, you don’t share in the property’s appreciation.

Benefits of Real Estate Crowdfunding

Real estate crowdfunding opens the door to property investment for people who might not otherwise be able to afford it. Here are some of the main benefits :

1. Low Capital Requirements

Real estate crowdfunding platforms usually have low minimum investment thresholds. This allows individuals to get started with as little as $500, making real estate accessible to those who don’t have large amounts of capital.

2. Diversification

Crowdfunding allows you to spread your money across multiple real estate projects, which can help reduce risk. Rather than putting all your money into a single property, you can invest in a portfolio of properties in different locations or sectors, thereby diversifying your exposure.

3. Access to High-Quality Deals

Many crowdfunding platforms offer investors access to deals that were traditionally only available to high-net-worth individuals or institutional investors. These include large commercial properties, multi-family units, and even luxury developments.

4. Passive Income

Real estate crowdfunding offers a way to earn passive income without having to deal with the day-to-day responsibilities of property management. Depending on the type of investment, you can receive regular payments from rental income or interest on loans.

5. Professional Management

With real estate crowdfunding, you are not responsible for managing the property. Professional sponsors handle the acquisition, development, and operation of the project. This allows investors to benefit from the expertise and experience of professionals without getting involved in the complexities of real estate management.

Risk Factors in Real Estate Crowdfunding

While real estate crowdfunding presents a unique opportunity for investors, it is not without risks. It’s crucial to be aware of these risks before committing your money.

1. Market Risk

Real estate is subject to market fluctuations, and downturns in the property market can affect your investment. Property values can decline, rental income can dry up, or projects can be delayed due to external factors such as economic recessions or natural disasters.

2. Project-Specific Risks

Not all real estate projects perform as expected. A project might run over budget, take longer to complete, or fail to meet occupancy targets. If a project doesn’t generate the expected income, your returns could be lower than anticipated—or you could lose your investment entirely.

3. Liquidity Risk

Real estate investments are generally illiquid, meaning that you can’t easily sell your investment and get your money back. Crowdfunding platforms typically have holding periods of several years, and some may not offer any early exit options.

4. Platform Risk

The platform you invest through plays a significant role in your success. Not all platforms are equally reputable or reliable. Some platforms may go out of business, leaving you with no way to track or manage your investment.

How to Minimize Risks

To reduce the risks associated with real estate crowdfunding, investors should take several precautions:

1. Diversify Your Investments

By spreading your investments across multiple projects and property types, you reduce the impact of any single project’s failure on your overall portfolio. Spreading your investments across different projects is essential for minimizing risk in real estate crowdfunding

2. Research the Platform

Before investing, thoroughly research the crowdfunding platform. Check its reputation, the types of projects it offers, and the transparency of its fees. Read reviews and look for any signs of regulatory compliance issues.

3. Analyze the Sponsor’s Track Record

The success of any real estate project largely depends on the experience and expertise of the sponsor. Make sure to research the sponsor’s past projects, how they performed, and whether they have a solid track record of delivering returns to investors.

4. Understand the Financials

Always review the financial projections for the project and ensure that they are realistic. Look for red flags, such as overly optimistic return projections, and make sure you understand the fees charged by both the platform and the sponsor.

Expected Returns in Real Estate Crowdfunding

The returns on real estate crowdfunding investments can vary widely based on the type of investment and the project’s performance.

- Equity investments typically offer returns ranging from 8% to 15% per year, depending on the success of the project and the appreciation of the property.

- Debt investments tend to offer more modest returns, usually in the range of 5% to 10% per year, with lower risk.

Keep in mind that these returns are not assured and cannot be guaranteed. The performance of the real estate market and the specific project will ultimately determine your profit.

Tax Implications of Real Estate Crowdfunding

The income you earn from real estate crowdfunding is generally subject to taxes.

- Equity investments: Returns from equity investments, such as rental income or profits from property sales, are typically treated as ordinary income or capital gains, depending on how long the property is held.

- Debt investments: Interest earned from debt investments is usually taxed as ordinary income.

It’s advisable to consult with a tax professional to understand how your real estate crowdfunding investments will affect your tax situation and whether there are any tax-advantaged strategies you can employ, such as investing through a self-directed IRA.

Popular Real Estate Crowdfunding Platforms

There are several real estate crowdfunding platforms to choose from, each with different investment offerings, minimum investments, and fee structures. Here are some of the most widely recognized platforms:

1. Fundrise

Fundrise is known for its user-friendly platform and low minimum investment, starting at just $10. It offers a variety of real estate investments, from residential to commercial projects, making it a good choice for beginners.

2. RealtyMogul

RealtyMogul provides access to both equity and debt investments, focusing on commercial real estate. The platform is open to accredited and non-accredited investors and offers a range of investment opportunities.

3. CrowdStreet

CrowdStreet is aimed at accredited investors and specializes in high-end commercial real estate deals. It provides detailed information about each project and allows investors to take a more hands-on approach to selecting their investments.

Conclusion

Real estate crowdfunding is revolutionizing the way people invest in property, making it possible to get started with minimal capital. By pooling resources with other investors, individuals can access real estate markets that were once out of reach. With the potential for steady returns, passive income, and diversification, real estate crowdfunding can be an excellent option for those looking to invest in property with little money.

However, like all investments, it comes with risks. It’s essential to thoroughly research the platform, sponsor, and project before investing, as well as diversify your investments to minimize risk. Real estate crowdfunding offers a unique and accessible path to real estate wealth, but it requires careful planning and a long-term outlook to succeed.

FAQs

1. How much money do I need to start investing in real estate crowdfunding?

Many platforms allow you to start with as little as $500 to $1,000, though some may have higher minimums.

2. Is real estate crowdfunding safe?

While it offers an accessible way to invest in real estate, there are risks involved, such as market fluctuations, project delays, and liquidity issues.

3. What is the difference between equity and debt crowdfunding?

Equity crowdfunding involves owning a share of the property and receiving a portion of the profits, while debt crowdfunding involves lending money to a project and earning interest.

4. Can I sell my investment in real estate crowdfunding?

Real estate crowdfunding investments are generally illiquid, meaning you may need to hold onto them for several years until the project is complete or sold.

5. What kind of returns can I expect from real estate crowdfunding?

Returns vary depending on the type of investment. Equity investments can offer returns of 8-15%, while debt investments typically offer 5-10% per year.